The results of Monetary Policy Committee Meeting No. 6/2023 unanimously decided to maintain the interest rate at 2.50 percent annually.

Mr. Betty Disayathat, Secretary of the Monetary Policy Committee (MPC), announced the results of the MPC meeting on 29 November 2023 that the Committee unanimously decided to maintain the interest rate at 2.50 percent per annum.

At this meeting, one director was absent from the meeting.

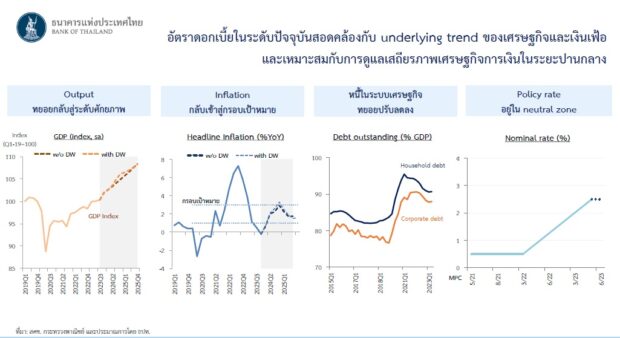

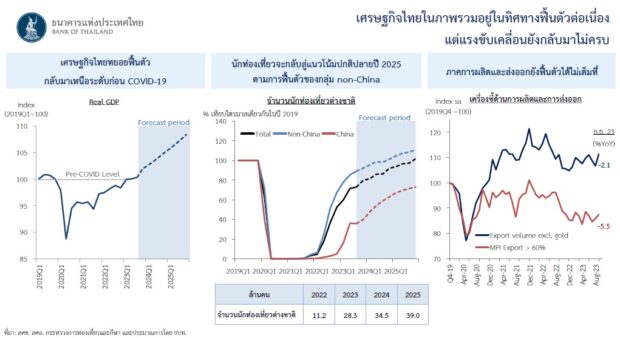

The Thai economy as a whole is on track for continued recovery. Despite the slowdown in the export sector and related production, the economy is likely to expand in 2024 and 2025 at a more balanced level. of domestic travel demand and the recovery of the export sector and inflation is likely to rise in 2024 in line with the economic recovery and supply pressures caused by the El Niño phenomenon. The Committee assesses that the official interest rate at the current level is appropriate in a context in which the economy is gradually recovering to its potential level. Maintaining inflation within the target framework in a sustainable manner facilitates the promotion of long-term economic and financial stability and the prevention of the accumulation of financial imbalances. It also helps maintain the ability of monetary policy to absorb uncertainty in the coming period. Therefore, it was considered appropriate to maintain the interest rate at this meeting.

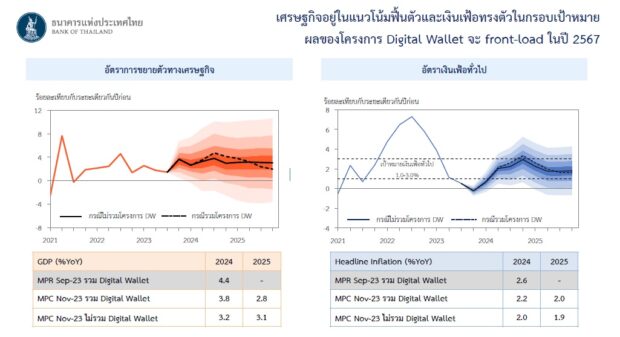

The Thai economy is likely to expand by 2.4 and 3.2 percent in 2023 and 2024, respectively, and if we include the results of the digital wallet project, the growth rate in 2024 is expected to reach 3.8 percent, down from the 4.4 percent estimated at the previous meeting. Overall, the Thai economy is still on the recovery trend. It received impetus from private consumption which expanded well after spending in the services category. Including support from improving employment opportunities and labor income. Meanwhile, the merchandise export sector and tourism sector recovered more slowly than expected. Partly from the Chinese economy and the global electronics cycle, which has not fully recovered in the coming period.

The economy tends to expand more evenly. In light of the continued recovery of the tourism sector and the return of the merchandise export sector to expand. But there is a risk that we will not benefit from the global economic recovery as expected due to changing structural factors.

General inflation tends to be within the target range. It is expected to reach 1.3 and 2.0 percent in 2023 and 2024, respectively, if the results of the digital wallet project are included. The headline inflation rate in 2024 is expected to reach 2.2 percent, down from 2.6 percent from the previous estimate. Headline inflation declined in 2023 from a high base in the previous year and temporary factors, especially energy costs for assisted living measures. Fresh food prices were lower than expected and core inflation, excluding the results of the digital wallet project, is expected to reach 1.3 and 1.2% in 2023 and 2024 respectively. However, the risks resulting from the cost of food prices that may rise still need to be monitored. Due to the phenomenon of El. Nino, including uncertainty about the conflict situation in the Middle East, which may cause global energy prices to rise.

The overall financial system is stable. Commercial banks have strong levels of capital and reserves. However, the development of credit quality must be monitored, which may be under pressure due to the debt repayment capacity of some SMEs and households, which remains fragile due to high debt burdens and slow income recovery. The Committee supports the continued implementation of debt restructuring measures. Including targeted measures and sustainable debt solutions for vulnerable groups. In particular measures to provide loans in a responsible and fair manner (responsible lending).

Overall fiscal conditions have tightened somewhat. Borrowing costs in the private sector tend to rise following recent adjustments in interest rates. But overall, this is not an obstacle to economic recovery. Business loans began to stabilize in line with economic activity. As for the exchange rate, the baht rose against the US dollar in line with regional currencies. It is important to predict the direction of the US Federal Reserve’s monetary policy.

Within the framework of monetary policy aimed at maintaining price stability. In addition to paying attention to the economy to grow sustainably and maintaining the stability of the financial system The committee estimates that the Thai economy is gradually recovering to its potential level. Inflation is within the target range and the current interest rate is at an appropriate level for stable economic expansion in the long term. Future monetary policy operations will be considered appropriate to trends and risks to the economy and inflation.

“Reader. Infuriatingly humble coffee enthusiast. Future teen idol. Tv nerd. Explorer. Organizer. Twitter aficionado. Evil music fanatic.”