What is an electronic tax invoice and how do you notice it? How is it different from the original tax invoice? What do we use called electronic tax invoice or not? Let's understand first so that we do not lose rights such as easy e-receipt starting now until February 15, 2023.

What is a tax invoice?

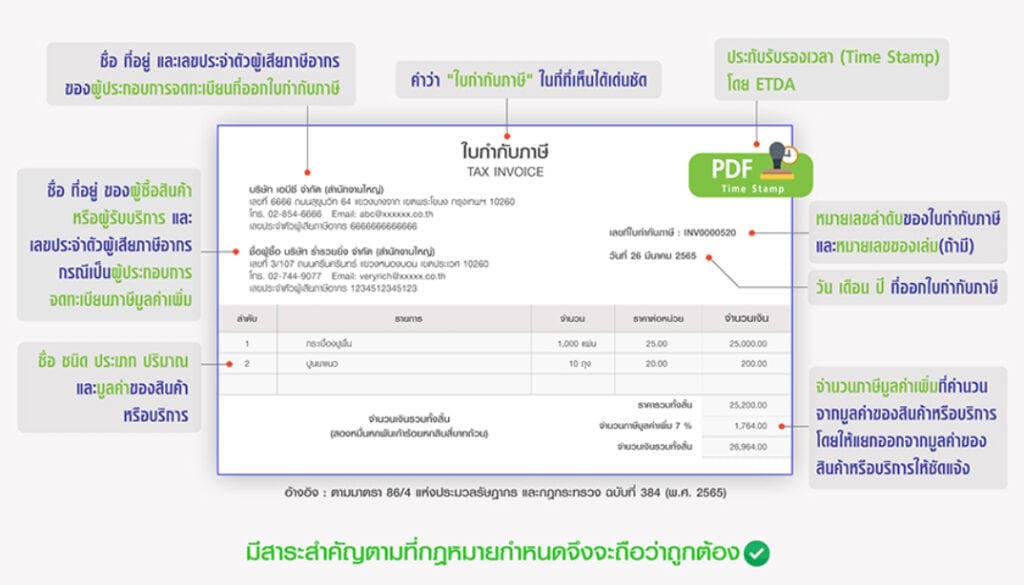

Tax invoice, the Thai name is tax invoice, which is a document in the tax system called VAT The seller is responsible for issuing the tax invoice to the buyer. It usually comes in paper form. A tax invoice is written on the header and the VAT amount is also specified.

The other card is mostly used to buy things at the supermarket. An abbreviated tax invoice will be issued. But it is noteworthy that this price already includes VAT. Without specifying the name of the motive

Electronic tax invoice

What is it

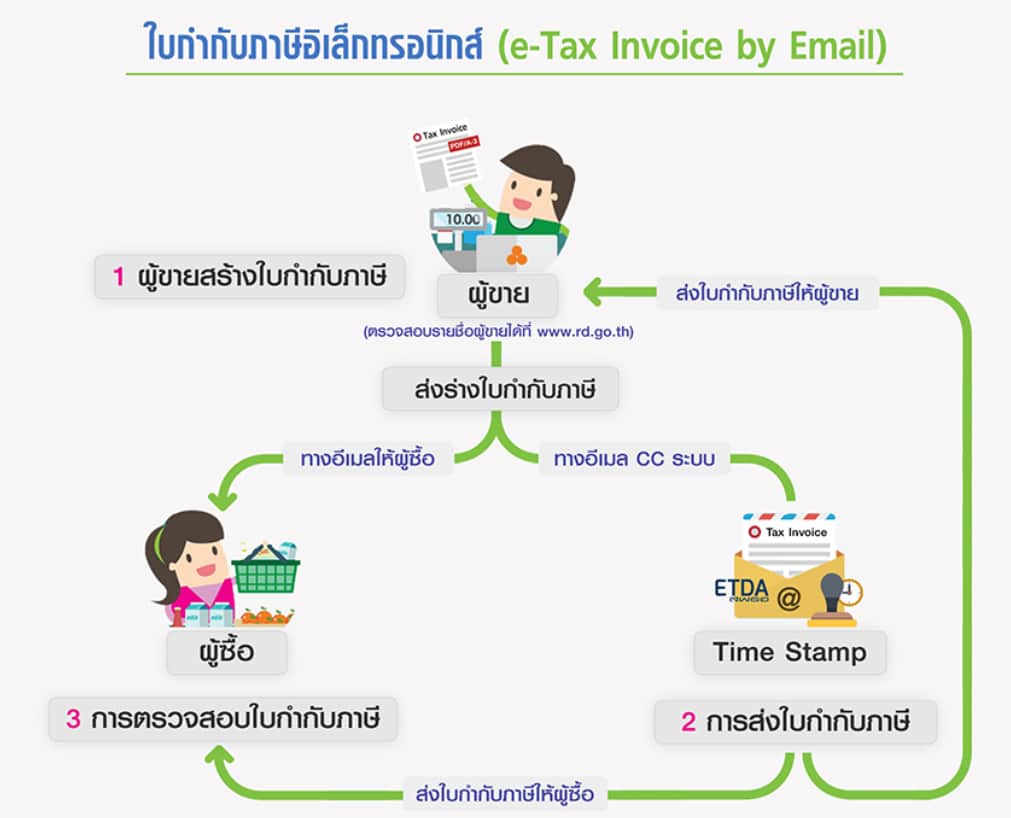

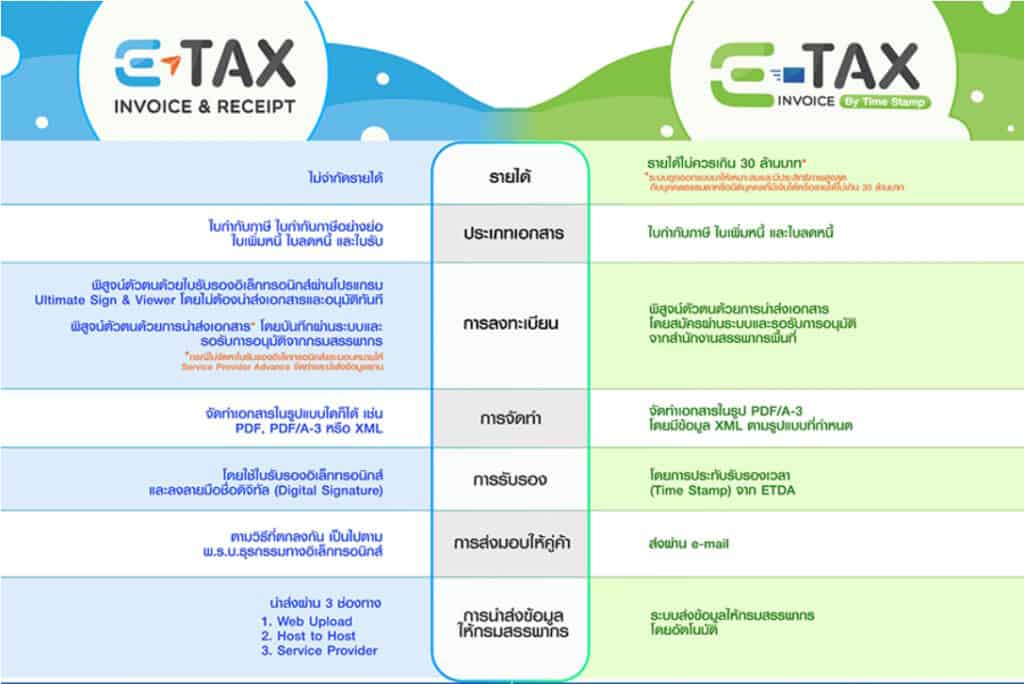

Add e to it, which means electronic tax invoice, i.e. electronic tax invoice. It is stated on the website of the Department of Revenue that an electronic tax invoice is a tax invoice in accordance with Article 86/4 of the Revenue Code, including a deduction voucher in accordance with Article 86/9 and a notice of deduction in accordance with Article 86/10 of the Revenue Code. The message is prepared as electronic information. and digitally sign (digital signature) or obtain a time stamp (time stamp) with the electronic tax invoice via email system

What is an electronic receipt?

An electronic receipt (electronic receipt) is a receipt in accordance with Section 105 bis of the Revenue Code. That has been prepared as electronic information and that has been digitally signed using methods specified by the Revenue Department

Something that many people may misunderstand

Many people misunderstand that an electronic tax invoice is a paper tax invoice. Let's convert it to a PDF and send it via email, shall we? The answer is no.

Because it will be an electronic tax invoice.Must adhere to the requirements of the Department of Revenue.

The condition is and stated in the receipt that this document has been prepared and sent to the Revenue Department by electronic means. Most of them are in large institutions.

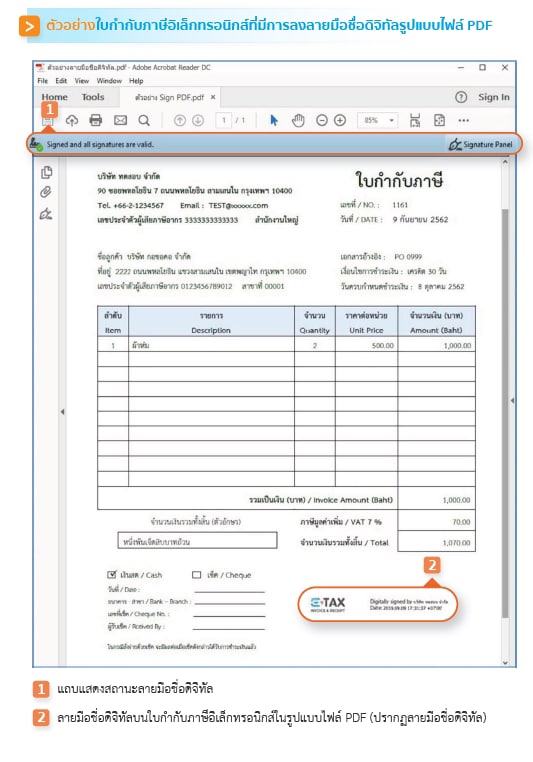

Note that at the end of the receipt there will be a statement in English as well. Website digitally by The company name is included, and when you open it with Adobe Acrobat, there will be a bar that says Signed and all signatures are valid, a bar that shows the status of the digital signature. We must preserve this document.

The other format is electronic tax invoice via email which is also an electronic receipt. But for small business owners

At the top is an ETDA approved timestamp and at the bottom is a time stamp. Tax invoices are prepared electronically and sent to the Revenue Department by electronic means. But there is no word Website digitally by Or there may be an “e-mail tax invoice” logo next to it, which means it is an e-mail tax invoice.

We will know which store or which company is specifically involved in this EASY E-RECEIPT project?

You can check in https://etax.rd.go.th/etax_staticpage/app/#/index/main#top Then click to check the list of people eligible to issue invoices…. Easy electronic receipt orclick here Then search by taxpayer identification number. From entrepreneurs If your name appears, it means that you are participating in the EASY E-RECEIPT project. You can issue an electronic tax invoice. Don't forget to bring your ID or ThaiD app to show as proof.

pointing to Revenue Department , TAXBugnoms iT24Hrs-S Cover

Read more articles and news on it24hrs.com

What is an electronic tax invoice and how can you reduce taxes on an electronic tax invoice?

Don't forget to follow news updates. Tips for good techniques, please follow us.

YouTube it24hrs

Twitter 24 hours

Tik Tok 24 hours

Facebook it24hrs

“Reader. Infuriatingly humble coffee enthusiast. Future teen idol. Tv nerd. Explorer. Organizer. Twitter aficionado. Evil music fanatic.”