Bitcoin (BTC) at $21,000 over the weekend amid warnings that volatility may continue to consume the market ahead of Monday.

S&P 500 sees second best week of 2022

info from Cointelegraph Markets Pro And the TradingView BTC/USD showed a broad rally in its latest trading range after US stocks ended the week strong.

As noted by market commentator Holger Schpitz, the S&P 500 ended its second best week of 2022, indicating modest relief across risky assets.

In case you missed it: S&P 500 gains >6% in second best week of 2022 as anti-inflation forces gather momentum and #feed it Hardened expectations are receding. Investors now see the key rate at just 3.4% at the end of 2022, a full 35 basis points lower than it was at the start of the week. pic.twitter.com/pE4TsrXXAp

– Holger Zschaepitz (Schuldensuehner) 25 June 2022

Bitcoin was on track to post a slight gain at its weekly close, the first – albeit small – weekly green candle since May.

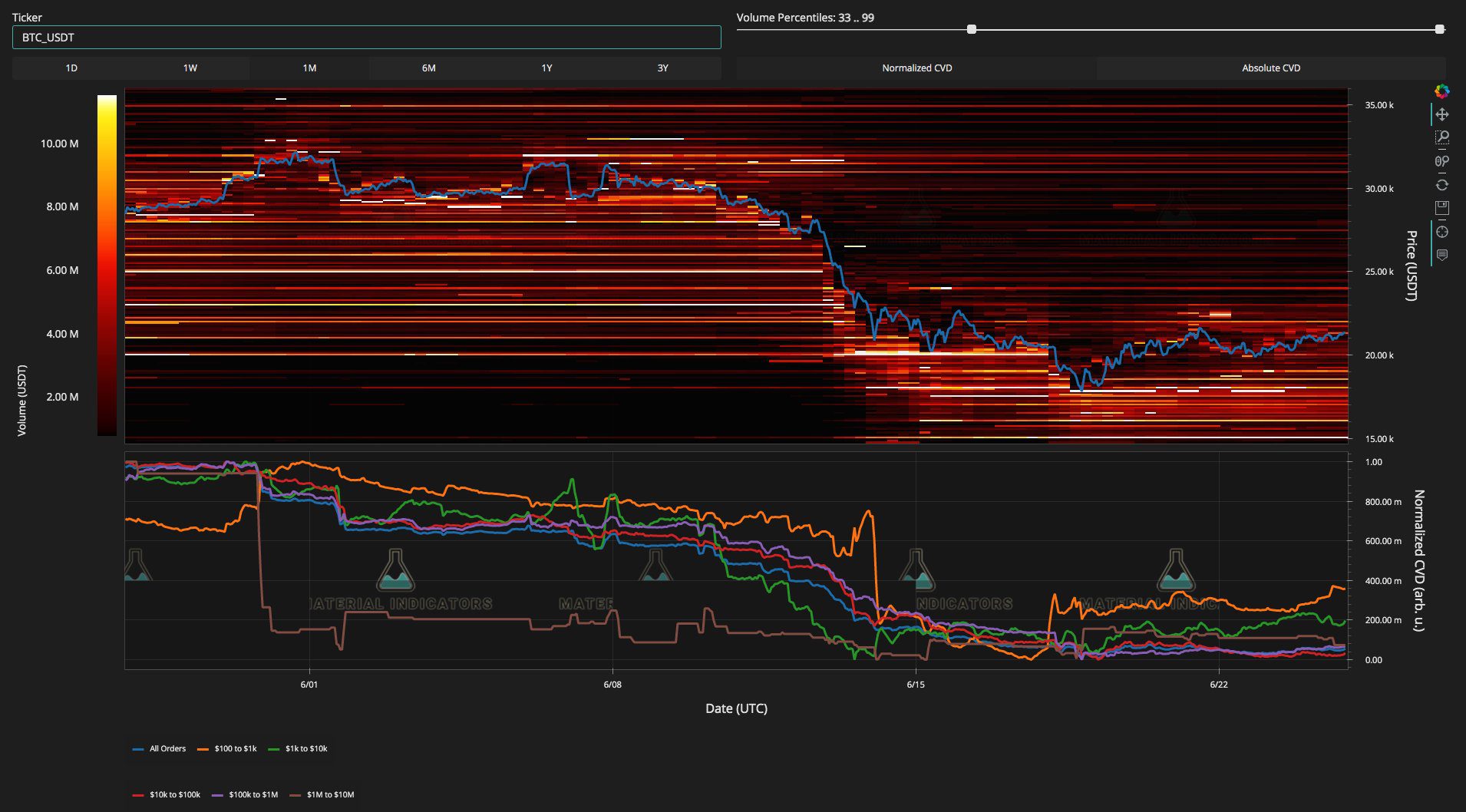

Before then, however, anything can happen, according to the on-chain analytics resource (MI) Physical Material Indicators.

Referring to the recent price action over the weekend, MI advised Twitter followers not to get complacent in the absence of weekday trading volume.

“If BTC can get 200 WMA out, there is room to run,” part of one post read.

“Wknds have been wild so buckle up. Retesting low levels can come in as fast as $24,000.”

The attached order book data chart from the world’s largest exchange Binance provided a glimpse into the buying and selling plans of traders. Below the spot, there was little support in terms of volume until $19,000, while extreme resistance was north of $22,000.

This level was the main 200-week moving average (WMA) for BTC/USD, which is needed to recover the bears to change direction, different sources think.

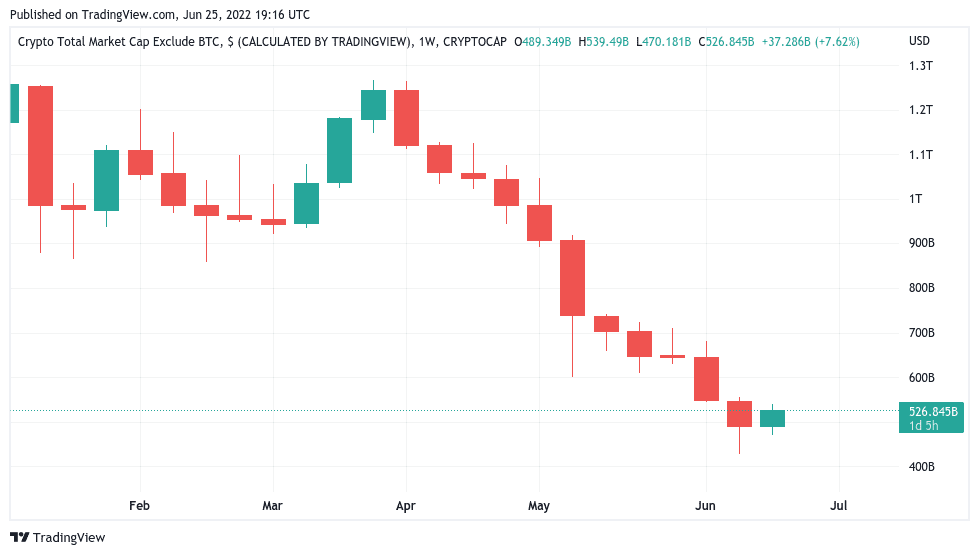

Altcoins set for first green week since March

Altcoins were also quiet during the day as they look ahead to an impressive week of gains within a gloomy macro market context.

Related: Ethereum price explodes as ‘bad news is good news’ for stocks

In the top ten cryptocurrencies by market capitalization, several coins are up nearly 30% from seven days ago at the time of writing.

Among them was ether (ETH), up 28% and the rest of about $1,200.

In a dedicated order history post, MI notes that ETH/USD has also retested the 200WMA, but this issue can still wait.

#ETH With a legitimate retest of the 200 WMA on the volume of the latest trend recognition signal. You want to see next week’s candle with a clean open and close above it without another sweep of the dips to validate it. With the concern that the 21 WMA will cross the 100 WMA and lead to another dump. #NFA pic.twitter.com/aLOXFideJX

– Material Indicators (MI_Algos) June 24, 2022

Elsewhere, Shiba Inu (graying) is up 50% from last week, while Polygon is up (maticHe stole the show with 70% weekly gains.

For Cointelegraph contributor Michael van de Poppe, there is still every reason to enter the crypto markets now.

“From the investment thesis (all things ceteris paribus), it’s a great period to look for the altcoins you want,” he said. Tell Twitter followers.

“In 2021, everyone was dreaming of buying those low price tags. Now the opportunities are there and people don’t dare make the decision. Typical.”

On a weekly basis, the altcoin market cap rose $37 billion over the course of the week, and is set for the first green candle since March.

The opinions and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should do your own research when making a decision.

“Reader. Infuriatingly humble coffee enthusiast. Future teen idol. Tv nerd. Explorer. Organizer. Twitter aficionado. Evil music fanatic.”