Real estate broker Compass Tech and Compass for renters and insurance sellers Tech Lemonade also collapsed. All eyes are on the SPAC deferred deal for Better.com’s “technical” mortgage broker. I can not wait.

by Wolf Richter about Wolf Street.

Even on Good Friday, the second day of a big recovery after five days of sharp declines, shares of the “tech” real estate company, Opendoor, collapsed 23%, having already collapsed in the previous months.

Opendoor Technologies [OPEN]Thursday evening, it was mentioned The company lost $191 million for the fourth quarter, bringing its 2021 net loss to $662 million, bringing its publicly disclosed four-year total loss to $1.5 billion. How could a house flipper lose $1.5 billion in four years? me too I do not know. But it’s not over yet. The company ended the year with an inventory of 17,009 unsold homes.

Opendoor went public in December 2020, at an IPO price of $31.47 amid massive pandemonium. By February 2021, the shares are at $39. If “February 2021” sounds familiar, it’s because that’s the month when the stock market started crashing beneath the surface as high values started crashing one by one, each on their own schedule. The damage was like that Started reporting in May 2021. And that’s just another chapter because it’s getting worse. On Friday, shares closed at $8.44, down 78% from their February 2021 peak and 73% below their IPO price (data via YCharts):

Opendoor reported that it purchased 36,908 homes in 2021 but sold only 21,725 homes (for $8 billion) during the year, leaving 17,098 unsold homes ($6.1 billion) in inventory.

Opendoor funded this stock with $6.1 billion of “unchallenged” debt backed by its homes. No recourse means if Opendoor defaults, the lenders get the house and can’t go after Opendoor’s other assets. If Opendoor can’t sell those homes and pay off the debt with the proceeds, it can turn the properties over to lenders and let them worry about selling the homes.

In addition, Opendor was under contract to purchase an additional 5,411 homes for $1.9 billion.

Two-thirds of these 17,009 homes are completed and ready for resale. About a third (about 5,500 homes) are “in progress” and are not for sale. Any of these 17,000 homes that are not listed for sale, including all 5,500 homes still in operation, are in an unknown pile of vacant homes that do not appear in the official “display” of homes and that do not appear as vacant homes Also.

Zillow did the same with a large portion of its 7,000 homes that were stuck in the pipeline before it left business last November and sold those homes mostly to institutional investors, who are now trying to figure out what to do with them. These houses stuck in a house-fin pipeline that are swapped are vacant, but not shown vacant, not for sale, and not shown as ‘supply’.

House flipping is easy – part one, buying a house, when money isn’t a goal, and you can spend your servers as much as you want. The rest is hard, and making money from it is even more difficult, especially if you paid too much in the first place. It turns out that the activity is not suitable for people who write algae.

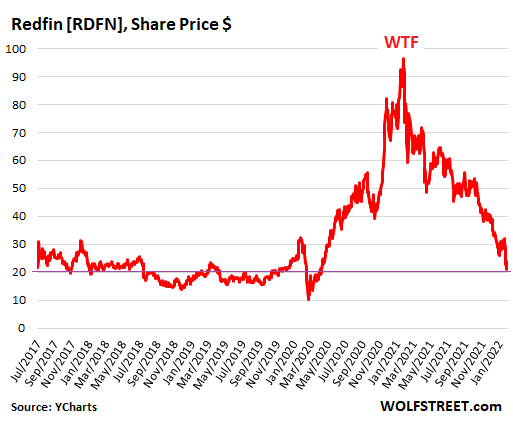

Redfinwho was originally an online real estate broker, also rode the algo-based flipper house craze starting in 2020. And its stocks [RDFN] The rocket soared upward amid the endless fuss of the crazy crowd of riders and reached $98.44 in February 2021 — yes, in February again.

Then the stock started a long crash. On Friday, they closed at $21.83, having collapsed 78% in one year. They are now below where they were after the first day of trading after the IPO in July 2017:

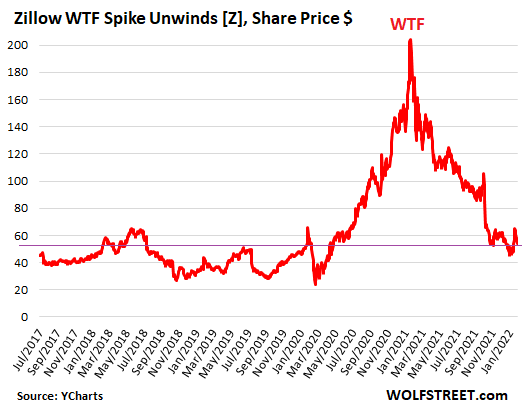

Zillow [ZG] She got a brief respite in her meltdown when she announced on February 10 that she had lost $881 million in 2021 on her home venture, which Came non-stick in November 2021when it revealed it was laying off 25% of its employees and getting out of the house-flipping business, getting rid of the 7,000 homes it had purchased.

She later revealed that she sold most of these homes to institutional investors – not to people who might have wanted to live in them. Until these vacant homes are offered for sale, they do not appear on the official “offer”, and many may eventually appear on the rental market. And while all of this is going on while they’re shuffled, they don’t appear as vacant either.

The $881 million loss was less than feared, and the stock magically rebounded over the next three trading days, but has since given up part of it. Shares closed Friday at $57.95, down 73% from their highs a year ago, and around the level they were in February 2020 before the crash:

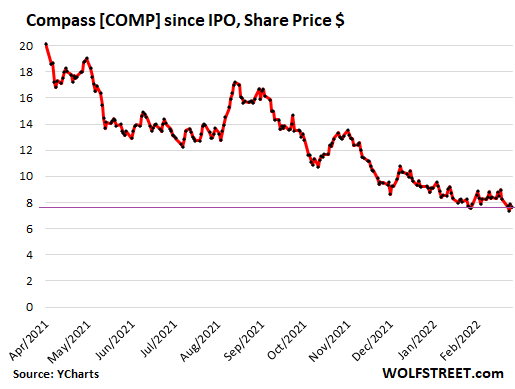

compass, a real estate broker that calls itself a “tech company that is reinventing the space,” is one of those examples — one of many — when you realize something is seriously wrong on Wall Street. But well, people enjoy their trading apps, and if it cleans up, so be it.

Compass has grown by using Softbank and other investors’ money to buy into real estate brokers across the country. Over the five years of publicly disclosed financial statements, Compass lost $1.44 billion. How can a real estate broker in the hottest housing market, no questions asked, lose $1.44 billion? This was a rhetorical question.

compass arrow [COMP] It peaked on the first day of trading, after its initial public offering in April of last year, at $22.11 and has fallen since then. They closed at $7.65 on Friday, having fallen 65% in the 10 months since their first-day trading high, and are now 58% below their IPO price of $18 per share:

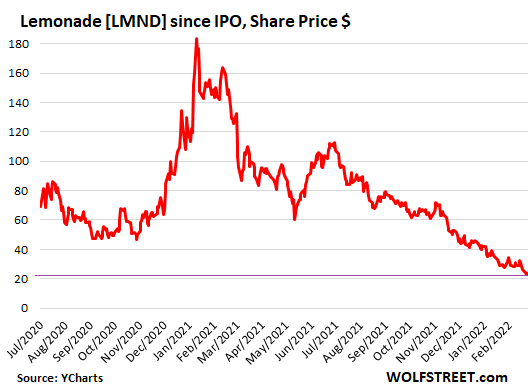

Lemonade [LMND], which was promoted as an “insurance technology company” and sells insurance to renters, homeowners, pet owners, etc., went public in July 2020 at $29 per share and on its first day of trading, amid massive fuss, rose by 139 %. Then it continued to rise until it reached $182 in January 2021. Then came February 2021, when that entire supply started to collapse.

On Friday, shares closed at $23.48, 83% off their high, and 19% below the never-trading IPO price because the first trade was at $50 a share, causing tech stock critics to lament how The company “mispriced the IPO” and the amount of money “left on the table.” Yes, that was how crazy the bid was at the time.

Waiting for the stock price to crash is Better.com, a “tech” mortgage lender, powered by Softbank. It’s not a publicly traded stock yet because its merger with SPAC was delayed in December 2021 after the CEO fired 900 employees, mostly in India, through a viral Zoom meeting, that idiot.

With the SPAC merger, and thus the cash flow delay, the company raised $750 million from Softbank and its backers from SPAC because these types of companies are constantly burning large amounts of cash and constantly need new cash to burn.

So I’m looking forward to the moment the stock finally starts trading so I can add it to my list of collapsed real estate “tech” stocks. This must be a good thing. So let’s hope the merger with SPAC takes place.

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a mug of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

“Reader. Infuriatingly humble coffee enthusiast. Future teen idol. Tv nerd. Explorer. Organizer. Twitter aficionado. Evil music fanatic.”