Both KBank Private Banking and Lombard Odier point out that the economy has changed direction after interest rates crossed their peak. – Preparing to recommend investment strategies for the year 2024 to confront fluctuations and emphasize investment diversification. Asset risk management

KBank Private Banking joins Lombard Odier, a global private banking business partner from Switzerland. Organizing a symposium on the topic “Changing Tides: Economic Dynamics and Portfolio Rebalancing after Interest Rate Rates” to assess the global economy in 2024, which is expected to continue to grow. But at a slower rate

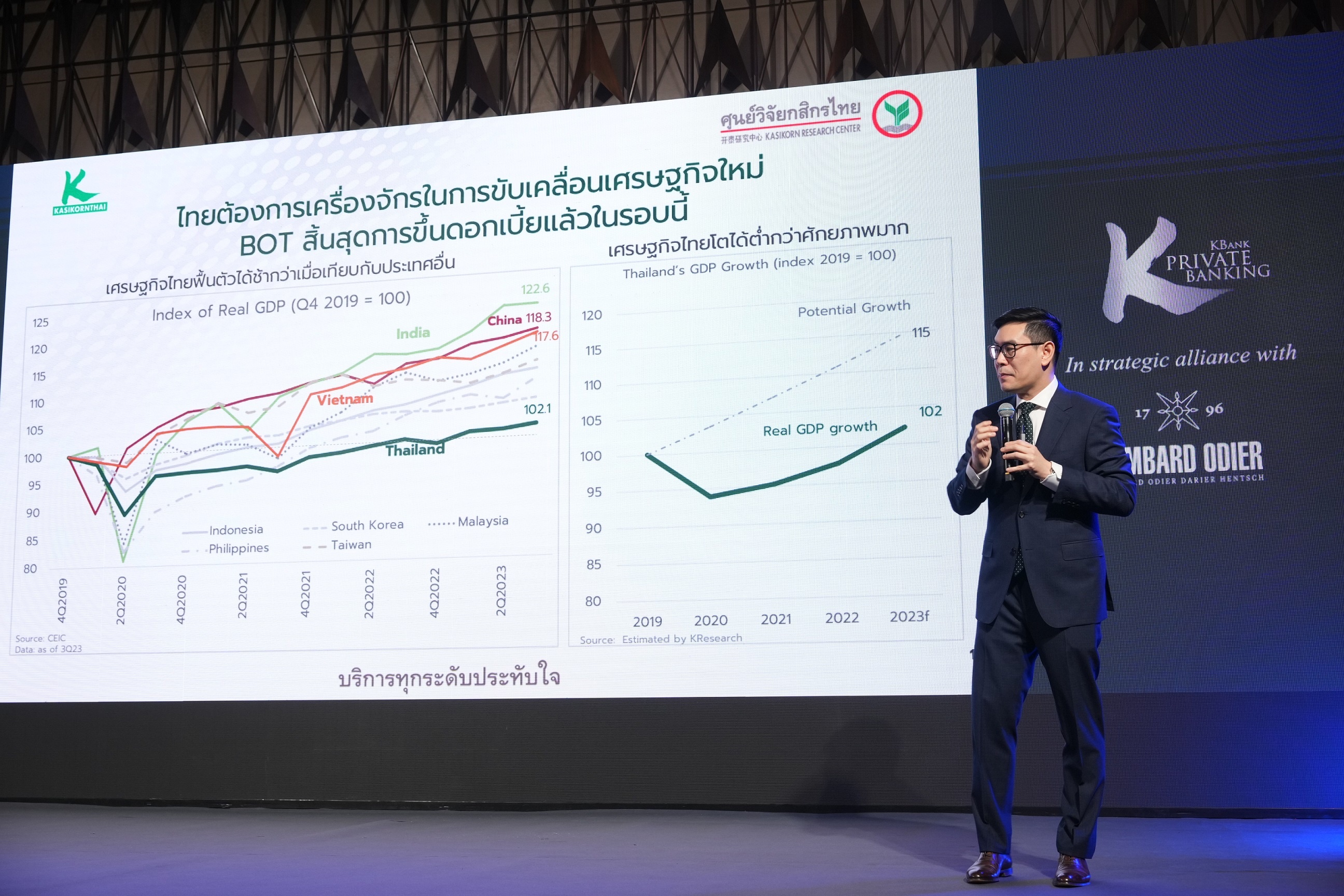

It indicates that there will be economic changes. After halting interest rate increases and gradually decreasing during the month of March. While we still have to monitor geopolitics such as the US elections, he recommends dividing investments to achieve long-term returns by focusing on risk-based investments that are diversified into underlying assets around the world through the ALL ROADS series, along with investing in debt instruments, stocks and alternative investments. Kasikorn Research Center believes that Thailand needs machines to drive the new economy. For the Thai economy to continue to grow, the Thai GDP this year is expected to grow by 3.1%.

Jerawat Sovonbaibun Private Banking Group CEO, Kasikorn Bank, revealed that in the past year, investment markets face many events that create volatility. Starting at the end of the first quarter, global financial stability was destabilized. From the closure of Silicon Valley Bank (SVB) and the crisis of Credit Suisse (CS), while the market improved in the second quarter. Inflation in the United States is approaching its highest point

Jerawat Sovonbaibun

However, in the third quarter, the Chinese economy failed to recover as the market expected. This makes the overall market weaker again. Coupled with uncertainty about the Federal Reserve Bank or the US Federal Reserve and it is unclear whether interest rates will stop rising or will continue to rise, this is followed by the conflict between Israel and Hamas that began in early October. Which led to the investment market continuing to decline

However, the market tends to improve. During November and December, as the Fed stops raising interest rates and signals that it will lower interest rates in 2024, global stock market returns for 2023 will rise by about 23%.

Burin Aduluwatana In 2024, the Thai economy is expected to grow by approximately 3.1%, supported by public investment, said managing director and chief economist at Kasikorn Research Center. Attracting the private sector Merchandise exports are expected to expand by 2%, including the number of tourists likely to rise to 30.6 million people.

However, if there is a digital wallet action, it could further expand the Thai economy to 3.6%, however, it is clear that Thailand needs new machines. Pushing the Thai economy towards growth towards its long-term potential, such as the electric vehicle industry. Opportunities to move production bases outside China, etc.

Burin Aduluwatana

Humin Lee Lombard Odier (Singapore), Asia's Chief Macro Strategist, summarized 5 interesting perspectives on the global economy as follows:

1. The global economy will continue to grow. But at a slower rate By the US economy, it is possible to avoid recession and slow growth through a soft landing. The European economy will continue to expand at a low level. At the same time, the Chinese economy still faces challenges. It is necessary to use economic stimulus measures to restore consumer and business confidence.

2. Inflation will continue to fall. In the United States and Europe in particular, inflation in China will remain stable near 1%.

3. US and European central banks have already stopped raising interest rates in 2023 and will start cutting rates from March 2024, but they will not fall to pre-Covid levels. The Bank of Japan will raise interest rates and exit the era of negative interest rates in the second quarter, while China will continue to maintain an accommodative monetary policy.

4. The market will be watching the policy. Especially the American elections, Sino-American relations, trade disputes between China and trading partners, including conflicts in the Middle East

5. More investment capital will flow into the bond market. As interest rates rise and will fall in 2024, the stock market still faces challenges because returns relative to interest are not as attractive as they were in the low interest era. Finding returns should focus on selecting existing stocks.

Humin Lee

For this year's investment strategy, KBank Private Banking recommends dividing investment funds for long-term wealth accumulation and expansion into two parts:

Basic wallet 50-70% by choosing a hybrid fund with a risk-based approach that diversifies risks across stocks, bonds and commodities, including volatility (VIX index) that uses systematic investment management principles. There are clear rules. It does not depend on market expectations or the fund manager. With the key strategy being highly proactive and flexible management. Depending on the economic cycle and important market indicators to make the portfolio flexible It is recommended to invest in funds that have effective asset allocation and risk management.

Satellite wallet 30-50% divided into the investment as follows:

1. Debt instruments Investing in government bonds and debt securities with good credit ratings. Emphasis is placed on tools with a long remaining life. Due to the current high interest rates this makes returns in the form of interest attractive. There is also an opportunity to profit from the spread when the Fed cuts interest rates.

In addition, government bonds are safe assets and provide good risk diversification. If the economy enters a slowdown

2. Involved like (1) Growth stocks around the world: After interest rates pass their peak and enter a down cycle, interest rates will benefit high-growth stocks. By recommending the distribution of investments around the world because technology stocks in the United States increased significantly in 2023. (2) Emerging Market Stocks: In addition to benefiting from outstanding economic growth potential, it is also supported by capital inflows that will flow after the Fed sends the signal to cut interest rates. This causes the US dollar to tend to decline. It is positive for investing in emerging markets.

3 Alternative investments By recommending diversification of investments into several hedge fund strategies, e.g (1) Macro and trend following trading strategies help generate returns and diversify risk. From the ability to use a variety of indicators to long/short major assets, whether stocks or debt instruments. (2) Major global currency trading strategies: taking into account fundamental factors such as interest rate differentials. Economic trends Inflation rate Balance of payments including inflow and outflow of funds.

In the end, though, the investment market remains in a constant state of turmoil, Jerawat said. But overall, it looks better. Therefore, investors are still advised to focus on effective risk diversification. Reduce volatility in a portfolio appropriate to acceptable risk levels to increase the chance of achieving consistent returns over the long term.

Other interesting stories: The Chirativat family launched CG Capital, a private equity fund management company.

Don't miss other interesting articles and stories. Follow us on Facebook at Forbes Thailand.

“Reader. Infuriatingly humble coffee enthusiast. Future teen idol. Tv nerd. Explorer. Organizer. Twitter aficionado. Evil music fanatic.”